No more than a month into the new year and so much has already happened, everywhere you look from the home to the high street to the manufacturer and the stock markets everything has been setting new heights and setting new lows. Many new products, services and devices, all of which present their own benefits and complications were introduced and new technologies brought major industries to a standstill.

Tech Stocks

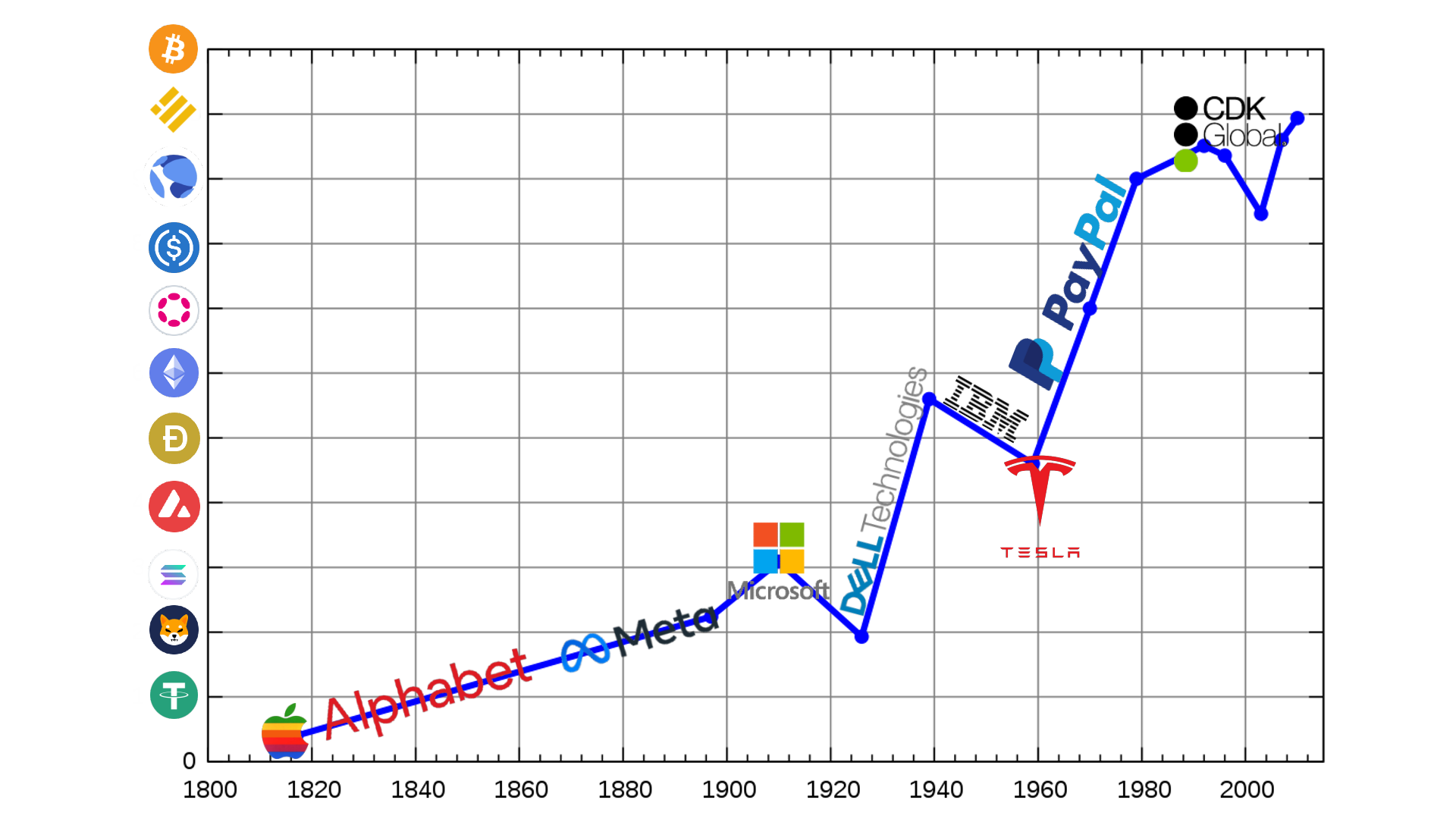

The technology stock markets (along with many other markets and cryptocurrencies) had seen predominantly continued gains throughout the pandemic reaching new heights never seen before, these gains however came to a grinding halt upon the US Federal Reserves announcement of several rate rises coming in to play later in the first quarter of this year, the announcement sent stocks across the globe plummeting, knocking over £38bn of wealth from the top 10 tech stock investors portfolios over the course of a week. But though the market looks a little unsettled for stocks going forward this year according to This is Money’s Financial Mail on Sunday expert Jeff Prestridge this could well be an excellent time to invest in tech shares, obviously time will tell.

Crypto

Cryptocurrencies, which are supposedly a store of value likened to gold, have proven to be no more than a very risky volatile gamble, according to Coinbase (as of 1st February 2022) there are in excess of 9,600 cryptocurrency offerings, each with the illusion that one can get rich quick, unfortunately this unregulated concept which is still in its infancy in the grand scheme of things, falls and rises inline with the US dollar and stocks, therefore proving they are not a store of value like gold which price runs independently of other stocks. Prices across the board fell by almost 50% from their highs and are currently struggling to gain any form of significant gains, many pundits in the field believe that cryptocurrencies are in for a long dark winter, with some sunlight upon the horizon, whereas the American Billionaire entrepreneur and media proprietor Mark Cuban and the real Wolf of Wall Street Jordan Belfort believe that at least 90% of cryptocurrencies will not survive another year, Jordan says “s***coins” like Shiba Inu and Dogecoin are outright scams with no value and no use.”

5G

The rollout of 5G in the US brought major US cargo and passenger planes to a standstill, the new technology that boasts 10 times the speed of 4G utilises part of the C-band spectrum in the ranges of 3 hertz to 3,000 gigahertz which is close to the frequencies used by key infrastructure electronics used not just in aircraft but in many other modes of transportation, the fear is, if both wireless signals are used within the same area they could scramble each others signals potentially causing aircraft to crash or be put off course. Concerns began in late 2021 after the Biden administration auctioned off a large proportion of the C-band spectrum to wireless carriers, for a sum over $81bn. A request for carriers to hold off installing 5G antennas around the airports has since been placed on hold for at least 6 months until the situation has been remedied.

Looking For The Best IT Support Services In Surrey?

Education

School cyberattacks are fast on the increase and what started off in the United States is quickly making its way across the globe. Though it is rarely reported upon as US schools do not have to publicly report cyberattacks, a freighting number of schools have gone under. Since 2016 there have been over 1,200 cyber attacks on schools, 400 of which occurred in 2020 alone when cybercriminals were thriving off schools ever growing reliance on technology during the pandemic, the attacks have severely affected teaching staff and students alike, losing years of work with a number of schools having to close their doors for good. The news comes at a time where increasing challenges threaten many US schools’ ability to stay open, Joe Biden has since pledged to keep schools open but so far little action has been taken to prevent many from falling victim. Many schools in other countries are on high alert and looking at alternative means to protect themselves.

Robots

Ocado the online food delivery service is known for using fulfilment robots like those used at Amazon warehouses to arrange, organise, shelve and pack items at speed, however for the first time Ocado’s robots are making new fulfilment robots which are said to be an improvement on the previous model. Though the technology is still in its infancy and is programmed by humans to ensure precision accuracy in the build, the robots use 3D printing technologies to build new pick and packing robots to replace their predecessors. The new 600 Series which replaces the older 500 Series robots is said to be lighter and far more cost effective. Robots have been used in the workplace since as early as the 1950s, the first of its type put into use was the Unimate produced by Joseph F. Engelberger and George C. Devol in 1956, the robot carried out spot welding and extracted die cast moulds from machines, however unlike at any other time robots are being manufactured to replace jobs in almost every sector, supermarkets and high street stores who have already been replacing humans at checkouts with checkout machines are looking at means to reduce further jobs such as stacking shelves with robots in the not so distant future, with China already leading the way.

The export boom during the pandemic unveiled Chinas deep routed and rapidly ageing population crisis, the country’s long standing tradition of ‘filial piety’ whereby children have a moral obligation to look after and support their parents through old age has almost come to a grinding halt due to the countries one child policy that ended in 2015. It has been estimated that since its implementation between 1980 and 2015 1 million families had lost their only child and therefore support. Due to this ageing population and therefore a shortfall in government funding for pensions along with the rising costs of living that has made the cost of manufacturing products more expensive and less competitive in the open market, the Chinese government are set to replace 70% of their workforce with robots in the coming years, I’m personally not sure how this will help the ageing population or any generation for that matter, other than making products more competitive on price. What I am sure about is that these new robot technologies will become commonplace across the world in just a few years to come.

Economy

While there seems to be a lot of gloomy news surrounding much of the tech arena of late, companies like Alphabet, the owner of Google have seen a sharp rise in ad spend. So what does this surge say about the market as a whole? If we look back through history we see a pattern on the lead up to and during recessions where companies either increase or massively decrease their ad spend revenue, and a buoyant ad spend could be just as good an indicator of a rising market as it is a falling one.

Just before the Great Depression in the late 1920’s while most were cutting their advertising budgets the likes of Kellogg’s were more than doubling their spend, in doing so, growing profits by more than 30% while their competitors fell to the wayside and shut shop. In 1973 while car makers dropped much of their advertisers, Toyota took advantage by taking all their competitors’ advertising slots, by 1976 Toyota became the largest imported car maker in the US and Europe, and there are many examples like this throughout the recession of the 90s and 00s, it is these attitudes like that of Sam Walton, the founder of Wal-Mart, which not only provide us with a glimpse of what may be happening within the wider economy but also an insight as to how to avoid falling foul of an economic downturn. When asked, “What do you think about a recession?” Sam responded, “I thought about it and decided not to participate.” And that attitude is what I believe many are adopting, hence the increase in ad revenue on the likes of Google. Though recession looks to be on the horizon it doesn’t mean business should reduce advertising spend to save money, on the contrary those who spend heavily on the lead up to and during tough times survive and prosper.